Personal Account Services

Our Personal Account Services are designed to give you secure, flexible, and convenient control over your finances. Whether you are managing day-to-day expenses, building long-term savings, or planning future investments, we offer a full range of options tailored to your financial goals. From reliable checking and savings accounts to structured deposit solutions, every service is created with your financial stability and growth in mind.

In addition to traditional banking products, we also provide fixed deposit options and investment pathways that help you maximize returns while maintaining confidence and security. Our team is committed to guiding you through each solution so you can make informed, responsible financial decisions. At Community First Co-operative Credit Union, we ensure that your money is not only safe—but working for you.

LOANS PRODUCTS

As a co-operative we recognize the importance of providing affordable loans to our members for everyday uses. Community First Co-operative Credit Union (CFCCU) therefore provides a very extensive loan portfolio. This will better enable our members to get the financial assistance they need.

In order to access loans at CFCCU, you must be a member of the credit union. Each applicant must provide the loan officer with the documents outlined below.

Employed Person must submit

- Job letter

- Pay slip (two most recent)

- Social Security card

- Two valid Photo IDs (Passport + one other)

- Proof of Immigration Status

- Proof of Address within the last 6 months and in your name (Utility Bill / Bank Statement). If renting, a letter must be provided by your Landlord along with the actual bill. Your Voter ID can also be used.

- Guarantor (if required, should provide job letter, passport and one other valid photo ID, social security card, two recent payslips, and proof of address)

- Cash deposit (varies, dependent on the amount being borrowed)

Self Employed Person must submit

- Verification of Income

- Business License

- Social Security card

- Two valid Photo IDs (Passport + one other)

- Proof of Immigration Status

- Proof of Address within the last 6 months and in your name (Utility Bill / Bank Statement). If renting, a letter must be provided by your Landlord along with the actual bill. Your Voter ID can also be used.

- Guarantor (if required, should provide job letter, passport and one other valid photo ID, social security card, two recent payslips, and proof of address)

- Cash Deposit (varies dependent on the amount being borrowed)

Below is a list of loan products currently offered at the credit union as well as a list of additional documentation needed to complete a loan application.

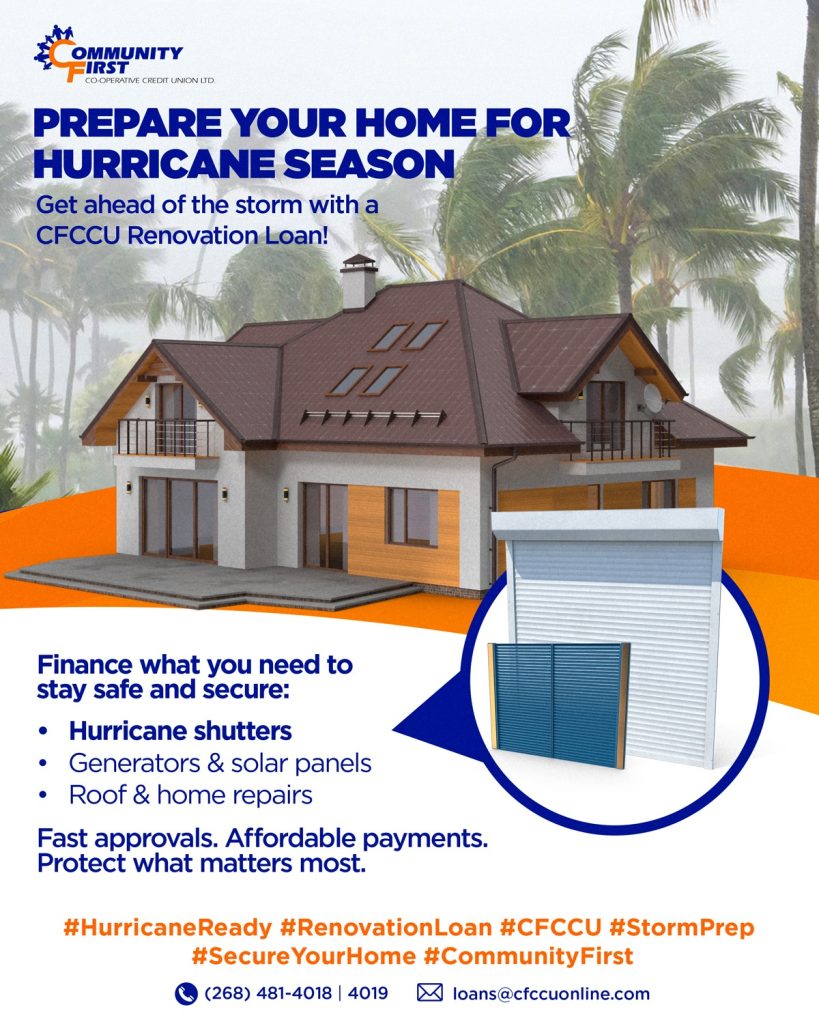

Repairs and Renovation Loan

- Types of Mortgage Loans

- 1) Property Purchase

- Minimum Cash Deposit of 5% – 10% (conditions apply)

- Copy of Sale Agreement

- Valuation of property (Valuators: Vier Dublin: 773-0197, John Bradshaw: 462-3627 / 786-9304)

- Copy of Land Register

- Life Insurance

- Property Insurance

- Insurance for house under construction

- Non-Nationals required alien land holders license

- 2) Construction

- Minimum Cash Deposit of 5% – 10% (conditions apply)

- DCA approved plans

- Valuation of land (Valuators: Vier Dublin: 773-0197, John Bradshaw: 462-3627)

- Typed detailed estimates (labour and material) signed by contractor/builder

- Permission to build on land if applicable

- Copy of Land Register

- Life Insurance

- Property Insurance

- Insurance for house under construction

Repairs and Renovation Loan

- Additional Documentation Required:

- DCA approved plans

- Valuation of land

- Detailed estimate – typed and signed by contractor/builder

- Copy of Land Register

Vehicle Purchase

- Additional Documentation Required:

- New Vehicle:

- 0% to 5% Cash Deposit

- Drivers Licence

- Purchase agreement for vehicle

- Insurance assignment/Letter

- Used Vehicle:

- 15% to 50% Cash Deposit

- Drivers Licence

- Registration of vehicle

- Purchase agreement for vehicle

- Valuation of vehicle (Valuators: Hazelroy Barnes – 562-9712 or 462-5534, or Stenlie Matthew – 460-9870)

- Overseas Vehicles:

- CIF Invoice from car company

- Insurance Quote

Land loans

- Additional Documentation Required:

- Minimum 5%–10% Cash Deposit

- Valuation of land (Valuators: Vier Dublin – 773-0197; John Bradshaw – 462-3627)

- Sale Agreement

- Copy of Land Register

- Non-Nationals require Land Holders Licence

- Survey Map

Debt Consolidation Loans

- Additional Documentation Required:

- Minimum 5%–10% Cash Deposit

- Valuation of land (Valuators: Vier Dublin – 773-0197; John Bradshaw – 462-3627)

- Sale Agreement

- Copy of Land Register

- Non-Nationals require Land Holders Licence

- Survey Map

Wedding

- Additional Documentation Required:

- Evidence to support pending nuptials such as:

- Copy of invitation (where applicable)

- Catering invoice

- Estimate of items to be purchased and the cost

Vacation/Travel Loans

- Required Documents:

- Invoice for ticket or ticket

Education Loans

- Additional Documentation Required:

- Letter of acceptance from an accredited college or institution

- List of costs associated with studying

- 15% to 25% Cash Deposit (Special Conditions Apply)

- Valuation of property (if being used)

- Copy of land registry (if applicable)

- Life Insurance (if applicable)

- Property Insurance (if applicable)

Furniture And Appliances Loans

- Additional Documentation Required:

- Proforma invoice from vendor

Disaster Preparedness Loans

- Additional Documentation Required:

- Typed detailed estimates (labour and material) signed by contractor/builder

- Appraisal and Title of property

Business Loans

- Additional Documentation Required:

- Business License from Intellectual Property

- Detailed Business Plan

- Verification of Income (Affidavit of means and audited financial statements)

- Guarantor (May be required)

- Cash Deposit (Depends on the amount being borrowed)

- Other documents may be required depending on the type of business and the amount

SimpleTransparentSecure

Are you interested in being a member? Fill out one of our application forms today!

Revel Rush Carnival Loan

Requirements

- Job Letter

- Pay Slip (Two Most Recent)

- Social Security Card

- Passport

-

Proof of Address within the last 6 months in your name

(Utility Bill / Bank Statement)

NB: If renting, landlord letter + actual bill required. Voters ID also accepted. - Invoices (Mas Troupes, Service Providers, Ticketing for Events, etc.)

Revel

Rush

Carnival Loan

Because your carnival should be stress-free and flexible – just like our financing

Borrow up to $5,000 EC for Carnival!

Covers costumes, fetes, mas make-up, photoshoots, accommodations and more.

1 Year to Repay

No Appointment Necessary

Just drop your documents off at our Credit Centre.